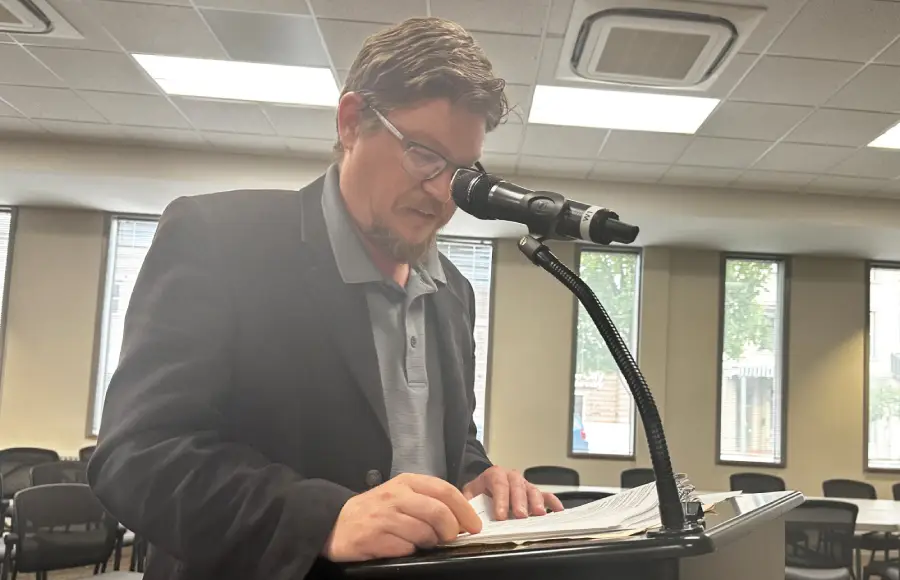

Warsaw Community and Economic Development Director Jeremy Skinner reads off the list of tax abatement compliance forms to the Warsaw Common Council he recommended they approve, which they did. Photo by David Slone, Times-Union.

WARSAW — A long list of tax abatement continuations was unanimously approved by the Warsaw Common Council Monday night, June 2.

Jeremy Skinner, the city’s community and economic development director, presented all the tax abatement compliance forms to the council first, who then approved them all in one swoop. Skinner recommended that all of them be approved.

They included:

• Instrumental Machine & Development, 2098 N. Pound Drive, tax abatement for real and personal property, granted in 2019, they are in their fifth year of abatement. They spent roughly $3.2 million in real property improvements and spent around $1.3 million in personal property and about $2.9 million in real property improvements.

• Little Crow Lofts LLC, 201 S. Detroit St., an affordable housing project. As part of the city’s commitment to those Indiana Housing & Community Development Authority funds, the city gave a tax abatement. They’re in their eighth year and spent about $8.4 million to rehabilitate the manufacturing facility into an apartment building.

• 802 Center, a senior affordable housing project. About $13.7 million was spent on the 72-unit senior housing facility by the developer. They’re in their fourth year of abatement.

• Flexaust Co. Inc. has had a few tax abatements over the years. In Skinner’s tally, he said from 2011 to 2017, they’ve added 103 new employees. For the 2011 tax abatement, they spent roughly $650,000 since filing and added 118 new employees. It’s in its 10th year. For the 2013 tax abatement, they added about 40 new employees and that’s in its 10th year of abatement. For the 2017 abatement, Flexaust was approved for real and personal property abatements for expansion projects at 1605 Center St. and 602 Leiter Drive, which is now in its seventh year.

• AJM LLC, 3350 Lake City Highway, real property tax abatement for refurbishing an existing building. They spent $1.6 million and hired 36 employees since applying for the vacant building tax abatement in 2022.

• There are three tax abatements for Patrick Industries, 1445 Polk Drive, with two for real property and one for personal property. Skinner said the personal property tax abatement is for the equipment the company bought itself and put into service, valued at roughly $3.2 million. They’ve hired 199 employees since opening up at that location. The tax abatement is in its seventh year.There were two phases for West Hill Development LLC for Patrick Industries, with the first phase being the 60,000 square-foot shell building at a construction cost of $4,485,000. It’s in its 10th year of abatement. The second phase was for an additional 64,000 square feet at around $4.9 million and is in its sixth year of abatement.

• Another tax abatement for West Hill Development LLC is for the Banner Medical building at 1295 Polk Drive. They filed for a real property tax abatement when it was built — $5,143,000 in real property improvements. It’s in its ninth year.

• A tax abatement for West Hill Investment Group LLC for Medartis, 1195 Polk Drive, is for an approximate 55,000 square-foot building for an estimated $8 million. “This is the second shell building we built and it’s in its sixth year of abatement,” Skinner stated.

• A tax abatement for West Hill Development LLC is for the third shell building at 1395 Polk Drive for an estimated cost of $11.3 million. A portion of it is occupied by Mentor Media. It’s in its second year of tax abatement.

• The tax abatement for Texmo Precision Castings US Inc. was originally issued by the county in 2016. The city annexed the property in 2019 and took over the tax abatement. They spent about $2.8 million in real property and $2.4 million in personal property and added 52 employees since 2016.

• Wildman Business Group, 800 S. Buffalo St., received a 10-year tax abatement for personal property in 2014. They spent about $2.1 million on personal property equipment and are in the 10th year of the abatement. In 2022, they applied for another real and personal property tax abatements, and they’re on their third year for those. They’ve hired an additional 45 employees since 2022, Skinner said.

• Zimmer Inc., 1800 W. Center St., was granted a 10-year tax abatement for personal property. They expected to spend roughly $28 million, and to date have spent $29.9 million. The tax abatement is in its third year.

• Biomet Inc. and Subsidiaries, 56 E. Bell Drive, received a tax abatement from the county in 2014 for $28 million in new personal property. They have spent about $16 million so far. The city annexed it in. It’s in its eighth year of abatement. Skinner said they only get abated for what they purchased.

• Biomet Manufacturing LLC, 56 E. Bell Drive, received another 10-year tax abatement in 2022 on personal property. They were adding new manufacturing, research and development and logistic equipment. They have spent around $7 million in new equipment to date and are in their second year of tax abatement.

• BTC Investments LLC, 133 Enterprise Drive, received a real property tax abatement for an expansion of 12,000 square feet. The project value was around $525,000. No jobs were attached to the investment. It’s in its fifth year.

• 2525 LP, 2525 Durbin Street, the former Arnolt property, is the most recent affordable housing project the city has done. Construction costs were around $8.7 million for 60 family apartment units. This is the second year of that tax abatement.

• Danco Medical, 905 Executive Drive, was granted a tax abatement on real and personal property two years ago. They spent $630,000 on real improvements and $3.2 million in new manufacturing equipment. They expect to create 20 new jobs over the next few years, Skinner said. The tax abatement is in its second year. Mayor Jeff Grose said not including jobs, “Just over $124 million in private sector investment.”

Skinner said there were a few other tax abatements that didn’t make it for Monday’s meeting, but hopefully he’ll get them in front of the council soon. There are about three to be presented at the next meeting.

After the continuation of those tax abatements were unanimously approved, Skinner presented a request to transfer an additional $50,000 within the Northern Residential TIF budget to cover financing costs for the Residential Housing Infrastructure Assistance Program bond that was recently closed on for the Belle Augusta housing project. The transfer is from improvements other than building to professional services and was approved 7-0.

Skinner also reported to the council Monday was the final approval for the Public Works facility project bond. It’s expected they will go to sell the bond around June 12, with closing around June 26. After that, they’ll finish the design and start construction. Substantial completion date of the project is July 2027. The guaranteed project cost by Robinson Construction is $13,298,020.33.

“It’s going to be an incredible facility for the street department, make them more efficient for the next 30 years for sure,” Skinner stated.