What you must understand

- Boone County Fiscal Court votes to lower real property tax rate to 8.5 cents per $100 valuation.

- County property tax rates have declined annually since 2014.

- Officials say the cut balances taxpayer relief with maintaining county services.

This year, property taxes in Boone County will be lowered once more.

The Boone County Fiscal Court unanimously decided on August 19 to lower the county’s real property tax rate from 9.2 cents per $100 of assessed value to 8.5 cents. This implies that a homeowner in Boone County with a $300,000 home would only pay $255 in property taxes.

In the meantime, the county will impose a motor vehicle tax rate of 14.2 cents per $100 valuation and a personal property tax rate of 9.5 cents per $100 valuation.

Since 2014, when the rate was 10.5 cents, Boone County’s property tax rates have been gradually falling annually.

“I’m happy that it’s seven tenths of a tax cut,” said Gary Moore, the Boone County Judge and Executive. That, in my opinion, is a significant rate reduction that our taxpayers are entitled to.

Property values, including residential valuations, are set by the county s Property Valuation Administrator, or PVA, who is an elected official. The PVA s office, based in the Boone County Administrative Building in Burlington, is not a county employee office but operates under the Kentucky Department of Revenue.

Delivered to your inbox every weekday morning, these are the stories that everyone in NKY will be talking about.

Land and any permanently associated structures are considered real property according to the Kentucky Department of Revenue. Construction equipment, artwork, antiques, coin collections, and manufacturing machinery are examples of tangible personal property that is taxable and physical. Watercraft and registered automobiles are not considered tangible personal property.

A compensating tax rate is the rate a taxing authority needs to set to generate the same revenue from real property as it did the previous year. The rate may be higher or lower than the previous year, depending on changes in property valuations. In Kentucky, calculations for the compensating rate do not include valuations for new properties within a jurisdiction.

How do property taxes work?

There are various categories for property taxes. Real property tax, often known as real estate property tax, is the initial and typically largest portion of your tax payment. In essence, this is a fixed tax on everything you own. For locals, this refers to homes and other real estate. For companies, this refers to office buildings as well as other structures and facilities that are utilized for business purposes.

However, another type of property that isn’t real estate is tangible personal property. Residents may not be subject to any personal property taxes, depending on the jurisdiction in which they reside.

There can be additional tax-related expenses depending on where you live.

Go here to learn more.

There are various categories for property taxes. Real property tax, often known as real estate property tax, is the initial and typically largest portion of your tax payment. In essence, this is a fixed tax on everything you own. For locals, this refers to homes and other real estate. For companies, this refers to office buildings as well as other structures and facilities that are utilized for business purposes.

However, another type of property that isn’t real estate is tangible personal property. Residents may not be subject to any personal property taxes, depending on the jurisdiction in which they reside.

There can be additional tax-related expenses depending on where you live.

Go here to learn more.

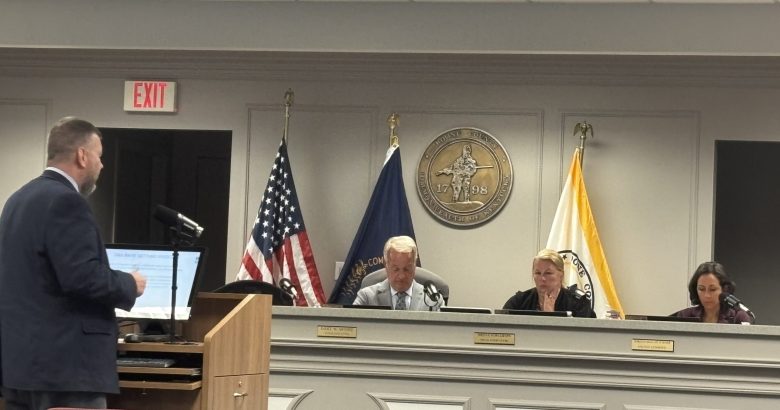

In his presentation to the fiscal court, Boone County Administrator Matthew Webster outlined the county’s justification.

In order to provide as much relief to taxpayers as feasible without compromising services, we think that one of the charges that we have had over the past year or two is to lower our tax rates as much as possible. He stated, “We think this is kind of right in that wheelhouse.”

According to Webster, the Property Valuation Administrator conducts independent assessments at the beginning of the rate-setting process. The Kentucky Department of Local Government then certifies the results, establishing the compensatory rate and the 4% growth rate.

Boone County statistics shows that while personal property values fell 9.5% from $4.1 billion to $3.7 billion, the county’s real property values rose 4.75% to $18.6 billion. The total property values in Boone County rose by almost 2% overall, giving the county the chance to reduce the property tax rate while still reaching its revenue targets.

In addition to helping residents save money, Boone County Commissioner Jesse Brewer told LINK nky that lowering the property tax rate allows the county to keep funding infrastructure, parks, and public safety.

According to Brewer, we may reduce our property tax rates without compromising on quality or services.

Moore once more addressed proposals for a consumption tax to take the place of property taxes at the end of the session. Moore clarified that a local sales tax cannot be imposed in Kentucky without a voter-approved constitutional amendment.

Moore added, “I just wanted to explain why we’re not talking about sales tax.” It would be the model of choice. We’ve been talking about that for a long time, but we’re unable to accomplish that, so we’re talking about the tools we now have.

Did you enjoy this story? Contribute to the next one.

Without community backing, independent local reporting would not be possible. We are able to continue covering the people, places, and issues that define Northern Kentucky thanks to your monthly donation.When you donate, you’re investing in all the stories that lie ahead, not just one.

AID IN LOCAL NEWS