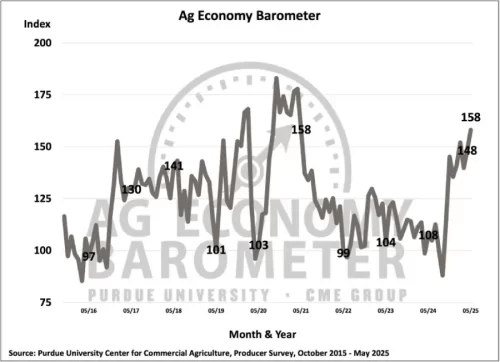

WEST LAFAYETTE — Farmer sentiment in May climbed to its highest level since May 2021 as the Purdue University-CME Group Ag Economy Barometer index reached 158, 10 points higher than in April. Farmers were more optimistic about both current conditions and their expectations for the future as the Current Conditions Index improved by 5 points to 146 and the Future Expectations Index jumped 12 points to 164.

Figure 1. Purdue/CME Group Ag Economy Barometer, October 2015-May 2025.

Key reasons behind the sentiment improvement were a much more optimistic view of U.S. agricultural export prospects, combined with a less negative view of tariffs’ impact on 2025 farm income than respondents provided in either March or April. The May barometer survey took place from May 12-16, 2025.

The Farm Financial Performance Index improved to 109 in May, 8 points higher than in April. The index’s rise indicates U.S. farmers expect 2025 to be a somewhat stronger income year than they experienced in 2024. However, despite expectations for stronger financial performance in 2025, the Farm Capital Investment Index fell 6 points from April to May, providing an index reading of 55.

Figure 2. Indices of Current Conditions and Future Expectations, October 2015-May 2025.

This month’s decline was all attributable to fewer respondents saying it is a good time to invest in their farm operations. Even with the investment index’s decline, it was still much stronger this year than in May of the last three years, when investment index readings ranged from 35 to 37.

Since November 2024, the investment index has averaged a reading of 54, which is higher than the 35-point average recorded from January through October 2024.

The Short-Term Farmland Value Expectations Index jumped up in May to a reading of 124, which was 14 points above the April reading and the highest reading since March 2024. The farmland index’s upward move was primarily the result of more producers saying they expect values to rise, which increased from 25% to 37% of respondents this month. Meanwhile, fewer producers reported that they expect values to hold steady, which fell from 60% of respondents in April to 50% in May.

Figure 3. Farm Capital Investment Index, October 2015-May 2025.

One of the drivers behind this month’s shift in farmer sentiment appeared to be a much more positive view of the U.S.’s long-run agricultural trade prospects. In May, the percentage of producers who said they expect U.S. agricultural exports to increase over the next five years skyrocketed to 52%, up from 33% who responded that way just a month earlier. This was the highest percentage of positive responses received to this question since November 2020. At the same time, the percentage of producers who said they expect exports to decline fell to just 12%, down from 24% who felt that way in April.

To learn more about U.S. producers’ views on trade, the May survey repeated a question that was first posed in barometer surveys in the fall of 2020. Producers were asked if they “Strongly Disagree”, “Disagree,” “Agree,” or “Strongly Agree” with the following statement: “Free trade benefits agriculture and most other American industries.”

Figure 4. Farm Financial Performance Index, January 2021-May 2025.

In fall 2020, an average of 49% of respondents chose “Strongly Agree” with the free trade statement. This stands in sharp contrast to the results from this month’s survey, in which only 28% of respondents chose “Strongly Agree.”

Responses to a question previously posed in the barometer’s March and April surveys provide additional evidence that producers’ views on trade have shifted. Producers were asked about the expected impact of the U.S.’s tariff policy on their farms’ income in 2025. In March and April, 57% and 56% of respondents, respectively, said they expected tariffs to have a “Negative” or “Very Negative” impact on their farm’s income. In May, this percentage fell to 43%, while the percentage expecting “No Impact” rose to 30%, compared to 19% and 22% in March and April, respectively.

Figure 5. Short-Term Farmland Value Expectations Index, January 2019 – May 2025.

To learn whether or not producers are facing difficulties in hiring adequate labor for their farm operations, the May survey included two questions related to farm labor. Fifty-one percent of respondents said they normally hire non-family members to work on their farms. A follow-up question was posed to this group to learn if they are having, or expect to have, difficulty hiring adequate labor as a result of the U.S. Administration’s policy to reduce immigration.

One out of four respondents who hire non-family members to work on their farms said they expected a “Lot of difficulty” (10%) or “Some Difficulty” (16%) in hiring adequate labor. Keeping in mind that barometer surveys do not target specialty crop producers who tend to hire more non-family labor, results suggest that reduced farm labor availability could be a significant concern for some U.S. crop and livestock producers.

Figure 6. U.S. Agricultural Exports Expectations Over the Next 5 Years, January 2019-May 2025.

Farmer sentiment in May reached its highest level since May 2021, as both farmers’ appraisal of current conditions and their expectations for the future improved. Producers’ more optimistic view of U.S. agricultural trade prospects, combined with an improved farm income outlook, appeared to be the primary drivers behind the improvement in sentiment.

In what could be an emerging issue, one out of four crop and livestock producers who typically hire non-family members said the U.S. Administration’s policy to reduce immigration could increase their difficulty in hiring adequate labor for their farm operation.

Figure 7. Producer Views on Free Trade, October-December 2020 and May 2025.